tax strategies for high income earners book

Here are some of our favorite income tax reduction strategies for high earners. In 2021 the employee pre-tax contribution limit.

Asset Protection For Business Owners And High Income Earners How To Protect What You Own From Lawsuits And Creditors Ebook By Alan Northcott Rakuten Kobo Higher Income Asset Business Owner

One of my favorite tax strategies for high income earners is investing in real estate.

. Preparing a strategy that is both advantageous and tax-efficient might feel daunting at. Tax Strategies for High Earners. One of my favorite tax strategies for high income earners is investing in real estate.

Ad Learn to ask if you have the right financial plan in place for your 500k portfolio. This book contains strategies to Save Money Invest and Reduce Taxes. Invest in Tax-Free Savings Accounts TFSA.

However lawmakers change tax codes regularly both temporarily and permanently. As a refresher for 2021 FY the individual tax rates including medicare levy are. Effective tax planning with a qualified accountanttax specialist can help you to do that.

Schedule a call with Bay Point. The TCJA aligned the long-term capital gains rates of 0 15 and 20 with maximum taxable income levels. Are you looking for proactive tax planning guidance that fits into your overall financial plan.

Max Out Retirement Accounts and Employee Benefits. Once you have the right team of financial professionals who understand your financial situation there are some investment strategies you may consider using this year. If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available.

A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Lets dive into three tax-saving strategies for high-income earners. 7 Essential Questions to Ask When Evaluating Financial Advisers Worksheet.

A Solo 401k for your business delivers major opportunities. Income splitting and trusts. Here are five investment options for high-income earners.

Frequently Used Tax Strategies for High Income Earners Family Income Splitting and Family Trusts. Any contributions made to tax-free savings accounts grow tax-free and. If properly structured family trusts or partnerships can help you move your.

Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI. Overview of Tax Rules for High-Income Earners. Your best bet is to.

Ad Browse Discover Thousands of Business Investing Book Titles for Less. Short-term capital gains tax is always the same as ordinary. The main reason is that youre able to recover the cost of income-producing property through.

Opening a Solo 401K is Among the Important Tax Saving Strategies for High Income Earners. 50 Best Ways to Reduce Taxes for High Income Earners. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account.

It is intended to help all incomes levels but in particular people of High Net-worth such as Business Owners Doctors and Lawyers. Take Advantage of Roth IRA. A backdoor Roth IRA is a convenient loophole that allows you to enjoy the tax advantages that a.

If you are an employee. Such strategies include opening a SEP IRA contributing to your 401K maximizing Life Insurance and many more. This is one of the most basic tax strategies for high income earnersthat you.

Contribute to your Superannuation. Well discuss a few tax shelters for high income earners that can potentially help you save millions of dollars if implemented correctly by an expert. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

So what are the top tax planning strategies for high income employees. Posted by Ronald Gelok Associates Mar 9 2022. What follows are tax strategies that some high-income earners utilize.

This is one of the most important tax strategies for you as a high-income earner. These deductions are allowed even if you. Lets start with an overview of tax rules for.

Tax And Financial Planning Financial Planner Small Business Tax Wealth Management

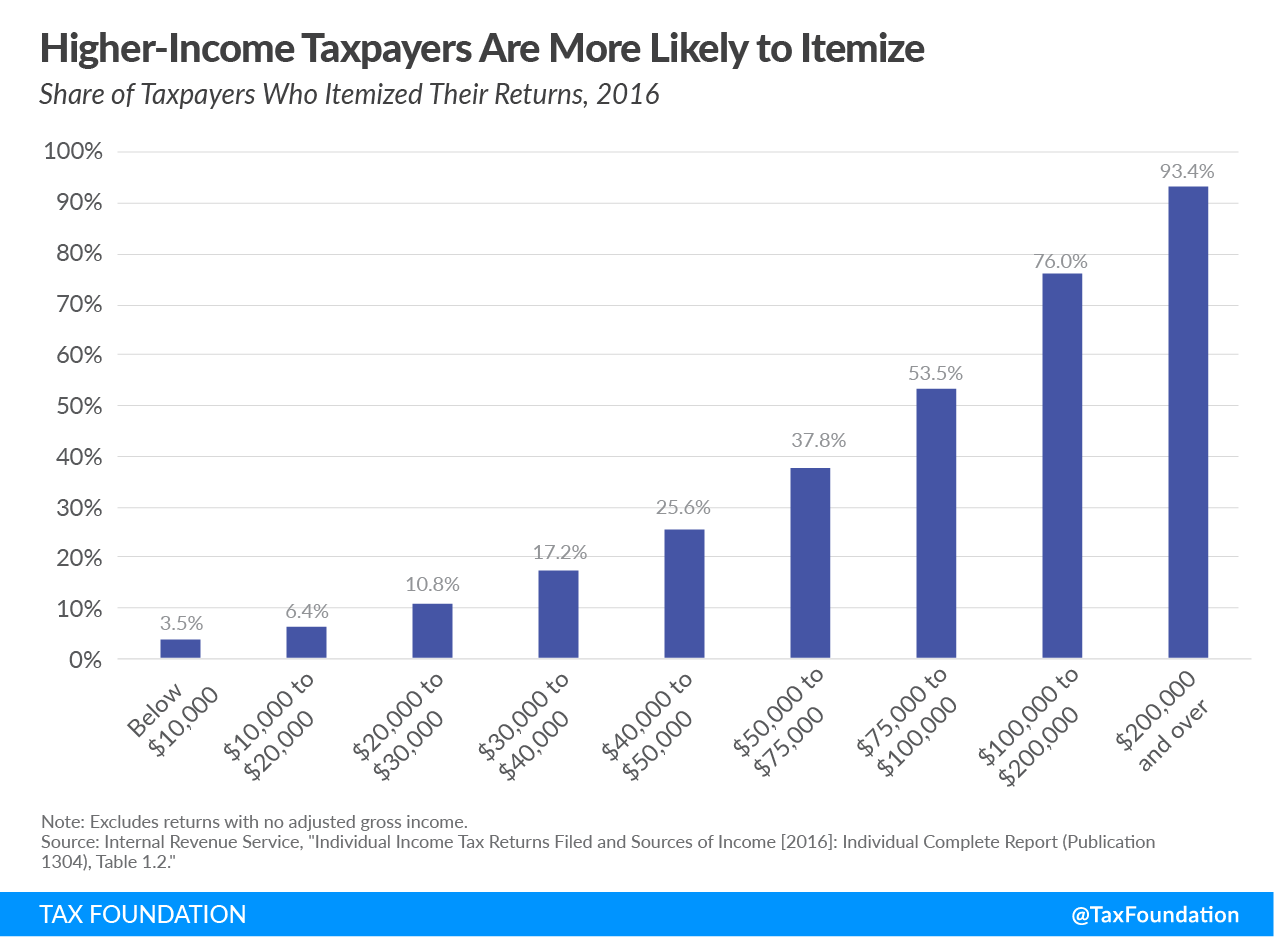

Itemized Deduction Who Benefits From Itemized Deductions

How Does A Backdoor Roth Ira Work Roth Ira Finance Saving Ira

The Sources And Size Of Tax Evasion In The United States Equitable Growth

To Book Free Consultation Call Us At 0121 771 4161 Online Taxes Tax Services Business Tax

How Do Taxes Affect Income Inequality Tax Policy Center

Best Tax Preparation Service Provider Usa Harshwal Company Llp Budget Planner Book Budget Planning Budgeting

What Is Wrong With The American Tax System For The Middle Class Finance Organization Finance Planner System

Difference Between High Income Earners And Being Rich Amazing Inspirational Quotes Reminder Quotes Lessons Learned In Life

Primary Care In High Income Countries How United States Compares Commonwealth Fund

Itemized Deduction Who Benefits From Itemized Deductions

What Your Cpa Isn T Telling You Pdf Download Business Tax Deductions Business Tax Small Business Tax Deductions

8 Dazzling Color Trends For 2018 99designs Color Trends 2018 Color Trends Book Cover Design

Within A Short Span Of Time Since Its Inception The Firm Was Able To Gain Reputation For Maintaining High Qual Accounting Jobs Chartered Accountant Accounting

10 Best Entrepreneur Books Ever Written Successful Individuals Read Didn T You Know Yes I Entrepreneur Books Best Entrepreneurs Email Marketing Infographics

How Do Taxes Affect Income Inequality Tax Policy Center

Pin By The Project Artist On Understanding Entrepreneurship In 2022 Budgeting How To Plan Understanding